Why go Self-Employed?

I decided to go self-employed after having various employed roles, I couldn’t seem to find a fulfilling enough role, and I dreaded going to work on a Monday morning, to do the 9-5 routine. Stepping away from the safety of a regular wage was a scary decision, however, once I did, having the flexibility to choose my hours and work-life balance (at the time around my young daughter), was a game changer, and I still enjoy the flexibility my client’s work allows. The relationship between a client, rather than an employee is very different, but in a good way.

Prepare:

Being your own boss is challenging! Be prepared not to win every client you pitch. In the beginning, this can seem disheartening, but each time you put in a pitch, see what you can change and always adapt your pitch for each client and their business. Do your research on a client! Companies House will become your best friend, firstly check if the company is legit, how long have they been trading? Has their turnover declined recently? Can they afford to pay you? Have they put in more than one strike-off? Has the company changed names several times? These could all be red flags. And most of all, read the room, if you get a bad feeling from a client, or you don’t think the working relationship will work, 9 times out of 10 your gut instinct is correct. Don’t accept any opportunities that you don’t feel comfortable in.

Enjoy what you do:

Choose a field you want to work in. Think about what type of businesses you want to work with, small to medium-sized businesses, family businesses, and which type of industry, creatives, artists, academics, start-ups, charities. Choosing the right company, in the long run, will make your job more enjoyable and hopefully build a long-lasting relationship.

Finding work:

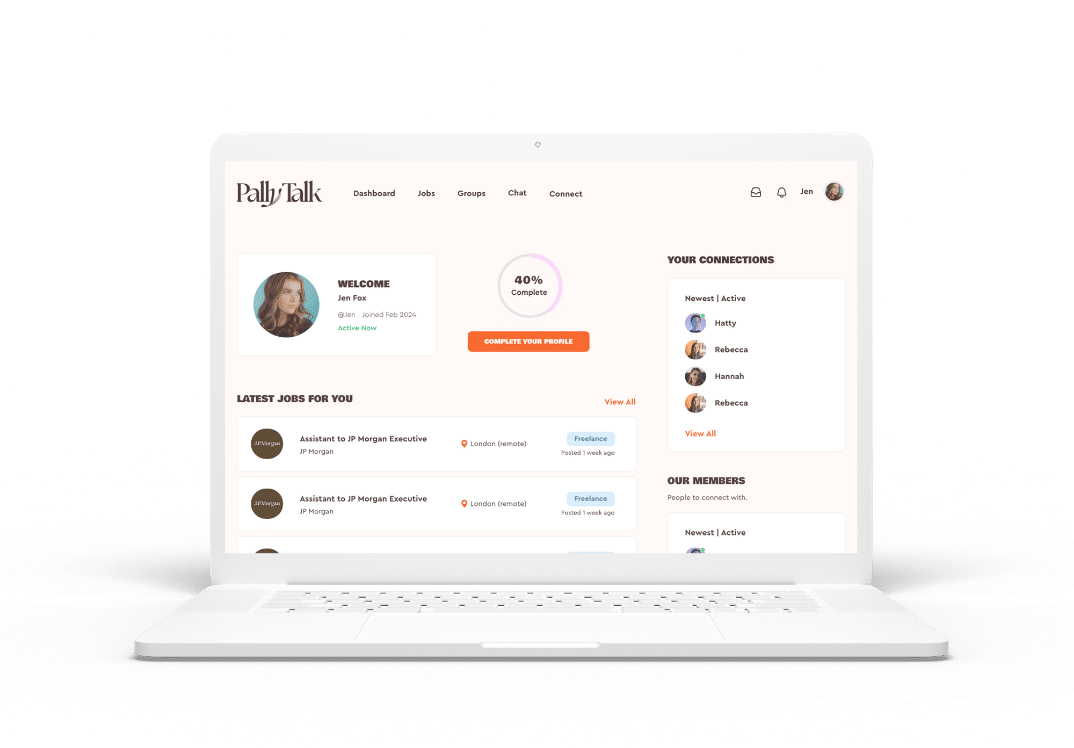

You can go down the more traditional routes by looking on Indeed and Linkedin, for clients looking to hire contractors, however, these platforms are inundated with people and have a high volume of applicants, and sadly some applications won’t even get noticed. The best way to find work is on specific VA groups on Facebook, LinkedIn, and websites, where other EA/PA/VA’s post associate work, or work from clients, or clients directly post themselves. There are virtual assistant agencies, which you can sign up for, you’ll work directly for these companies rather than for the client, however, bear in mind the pay is quite low, but the work can be consistent, there are also other sites such as Upwork, Fivver or Pally Talk.

Should I compromise?

Do you know your worth or willing to compromise? You can run the danger of pricing yourself too high or compromising too low. There are many factors to think about before making these decisions. Could this be a long-term client, they may in time accept an increased rate. Is the client struggling now, or is a start-up, that could improve over time? How much enjoyment will I get from this type of work? Only you can make these decisions.

Money

Research your rate, see how much other professionals in your industry are charging, and then consider the type of business, for example, if this is a funded charity or a start-up, they might not be able to afford a higher rate. If the company however is established, with a high turnover, it could afford a higher rate. Think about your expenses, in the beginning, you’ll need to create a contract, and pay for insurance, ICO, money laundering, website and advertising. Not to mention choosing the right software, below are some examples:

- Google workspace

- Microsoft Office

- Accounting software, Xero or Quickbooks

- Calendly

- Project software, Asana or Trello

Travel costs, you might choose to work fully remote and occasionally have a face-to-face meeting, or your client might want you to come into the office on a regular basis. Make it clear in your contract that travel costs are included in your hourly rate or reimbursable expenses.

When things go wrong:

Sadly, there may be occasions when you’ll experience late payment or non-payment of invoice (depending on what payment terms are in your contract), or a company going bankrupt, what should you do? Always start with a soft approach, ask the client, and if they respond and give you a respectable answer, follow this up, however, if you’re being ghosted, and more than 30 days have passed (which is the standard term), this is when to seek advice from a debt collector, bear in mind however you’ll have to pay a percentage of your invoice to the debt collection agency. A debt collection agency can also help when a company goes bankrupt, but the process normally takes longer and your client will have a representative enlisted to help settle all debts, the representative’s details will be displayed on companies house.